4 employees are frustrated that their Employer has outsourced payrolls to Relativity. Why so & Our opinion.

We have been a Payroll, Taxation & Compliance Outsourcing company since 2008, having processed about 80K payslips, about 10+ Lakh Form-16’s, more than 1 Million TDS records every year, and responsible for about 1000 Crores of taxes that are deducted, paid & processed under our advice/expertise. THIS IS REALLY HUGE, the ones with shared services, payroll, or Finance background would definitely agree with me & I am not boasting!

There are 3 CORE REASONS why companies outsource their payrolls to us:

- Data Confidentiality & Data Archival for future reference

- Knowledge & Expertise on Laws, Rules, Regulations& Processes

- Provide & periodically update the platform/software which incorporates updated rules as well as industry best-practices.

Of course, then each employer has their own reasons too like Long Term cost Vs value benefit, Cost optimization, better employee experience, etc. At the end of the day, all employers want to run an efficient HR team that balances cost as well as negates any risk as well. Risk is the last thing anyone wants on their shoulders & we understand that.

The reason why I am writing this post is to really understand why few (4) employees of our clients are frustrated and what can we do about it.

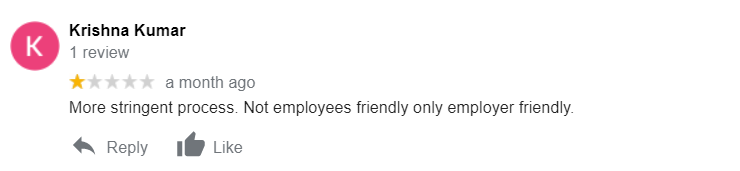

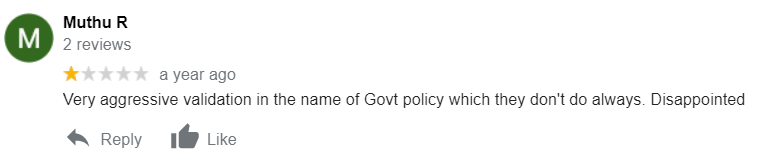

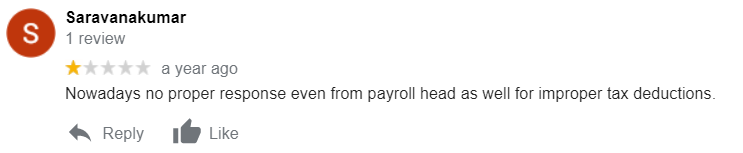

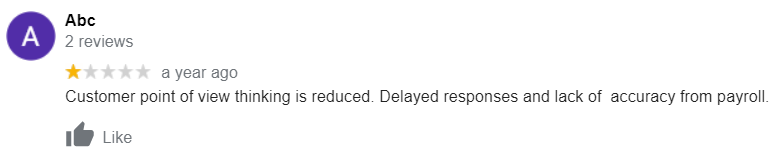

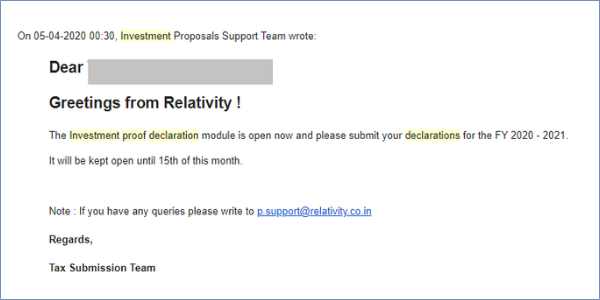

Please see the below screenshots:

All of the above reviews have one thing in common – “VALIDATION / TAX DEDUCTIONS”. If I see the time when such reviews are posted, it is the time when we do “Investment Proof Verification”. Let’s dissect them a bit in the next few paragraphs.

DEDUCTIONS:

Among many things, one of the core activities of payroll processing is to ensure appropriate statutory deductions are undertaken, on behalf of the employer. It could be TDS deductions, PT, ESI, PT, LWF, or any other statutory/policy deduction. This is the law & everyone in the eco-system is bound by it.

THEN, WHAT’S THE FUSS ALL ABOUT?

I believe it is ignorance, either knowingly or unknowingly. (Mostly Knowingly ?). When employees of our clients submit proofs that are incorrect or not inline with the published guidelines, such tax proofs are rejected. When tax proofs are rejected, a deduction or an exemption earlier claimed by that employee is reversed, leading to higher tax liability. Naturally, no one likes to pay higher taxes (or the tax itself).

ARE WE DOING THE RIGHT THING HERE?

The short answer is “YES”.

It is our responsibility, as a payroll processer to enable our clients to comply with the provisions of the Income Tax Act.

It is our responsibility that Employers don’t end up paying fines or penalties.

It is our responsibility that our clients don’t get a bad name for not complying with statutory deductions.

Here is the long Answer –

Investment Proof Declaration:

The whole cycle starts right after the Budget changes are proposed in February/March. These changes to the Finance Act / Income Tax Act are then incorporated in our ESS Tool. Once the changes are incorporated, revised guidelines are published.

These revised guidelines are extensively communicated to the SPOC’s and uploaded on our ESS tool for ready reference.

In April of every year, All employees are advised to declare the right tax deductions &exemptions they wish to claim. Again, this is what the Finance Act requires us to do. From April to December, run on basis of Declarations & from January to March, run on basis of Verified Proof Values.

Investment Proof Submission:

The groundwork for Investment Proof Submission & Verification begins in September (internal groundwork). Changes are documented, dates & calendars are decided and communicated to clients. Before they are communicated to clients, 2 SME’s (Subject matter experts) sign-off to ensure compliance & accuracy.

Every year, the Income-tax department also releases a Notification directing “How employers should deduct taxes”. Please see below:

Notification for 2020 –> Click Here

Notification for 2019 –> Click Here

Notification for 2018 –> Click Here

All those responsible for deducting taxes (directly the employer, indirectly the Payroll Processor) are required to comply with these provisions and notifications. There is very little NO scope for deviations.

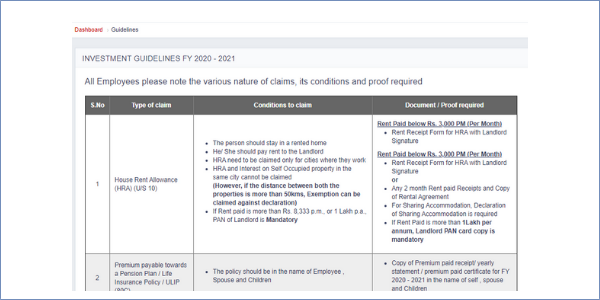

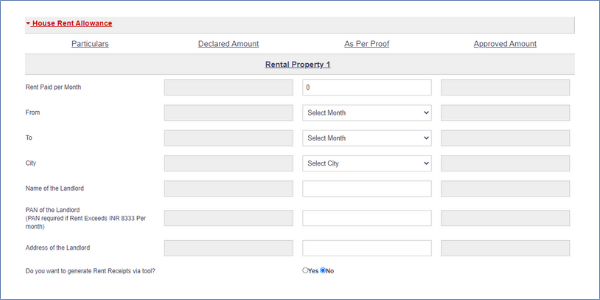

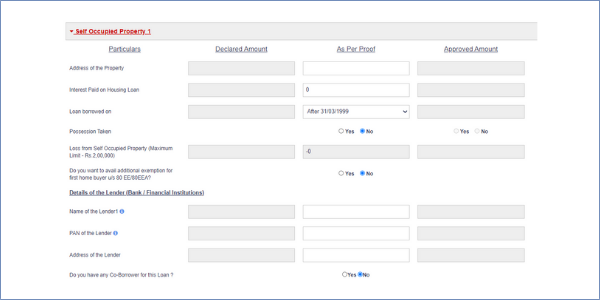

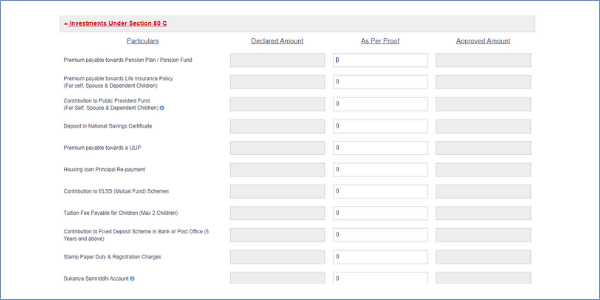

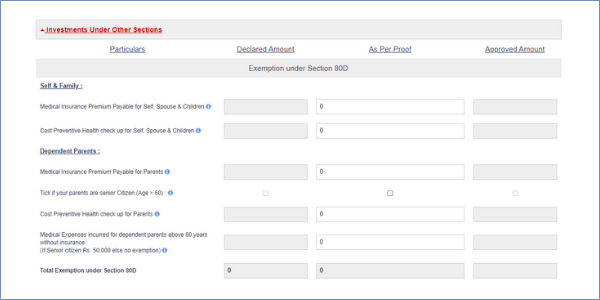

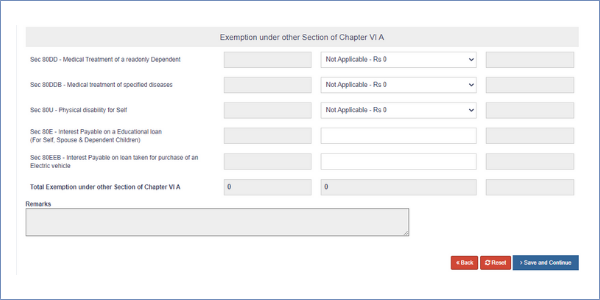

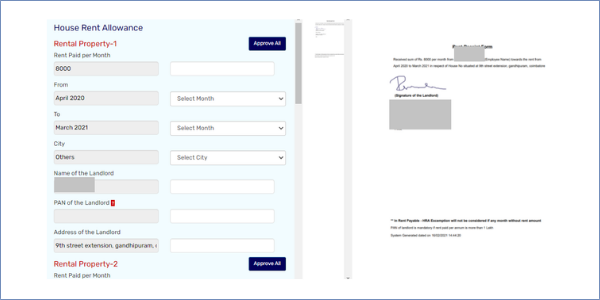

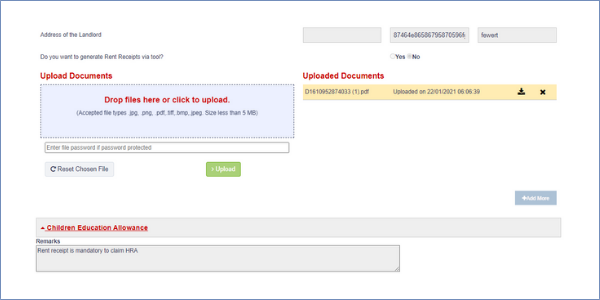

I have to say, I take great pride in our IPS Module on our ESS tool. We have designed it in such a way that employees understand from the ground up, that all these details & documents are required. In fact, we sacrificed Performance (of the ESS tool) for arresting/reducing erroneous submissions. You can see the screenshots of our IPS Module as below:

For Submitting HRA

For Submitting Self Occupied Property

For Submitting 80C details

For Submitting Other details of Chapter VIA

Investment Proof Verification:

These are then verified by Payroll Processors. People who have the knowledge, who are experienced, who deal with the Act day in and day out. You can see below:

All Validations are done based on Pre-Communicated Guidelines only, those that don’t pass are dutifully rejected.

Exceptional cases & cases where we have doubts are brought to the SME’s attention & are processed based on their input.

A Real Payroll Processor, will always stick to the Guidelines. Guidelines are based on Finance Act. Finance Act & Income tax act is drafted/proposed by the Ministry of Finance & approved by the Lok Sabha, Rajya Sabha & then approved by the Head of the Constitution, the Hon’ble President of the Republic of India.

Also as I have written earlier, we are responsible for the compliance of our clients. Hence we will always, I mean “always” be cautious & keep non-compliance away from our clients. That is who Relativity is. That is what a payroll processing/outsourcing company is supposed to do & I am sure that is what my other industry peers such as Ernst & Young, KPMG, PWC, ADP, Excility, Ascent, etc would do/are doing.

I would like to state that for the time these 4 people spent searching us on Google & write a negative review, if the same time was used to read the guidelines and submit appropriate proofs, everyone would have been much better off.

MY KEY TAKEAWAYS FROM THIS POST:

- I am glad that my team is doing the right thing. Going by the rules & guidelines.

- But clearly, there is a gap. My team should think out of the box to see how we can better employee experience for our clients. (To do the item for my team)

- A big thank you to all our clients for standing by our side, always.

- I am contemplating if 60 minutes of my time sitting at a Café Coffee Day at 9PM and elaborating why we do what we do, is really worth it.

SUGGESTION TO EMPLOYERS:

- Relativity or any Payroll Outsourcing Company is there to protect you from Non-Compliance. Because you should not be penalized/fined.

- There is only 1 expectation that we Payroll Companies have from you – Educate your people on guidelines.

- If you need any more support, we will be happy to assist. You just need to ask.

- Also, no-one likes to pay tax. So beyond a certain point, you should understand that people will be people whatever we educate them

SUGGESTION TO INDIVIDUALS:

- Relativity will always protect your employers from deviations / non-compliance / penalties and fines. After all “employees” exist because “Employers” exist.

- If there is a regulation to not verify the proofs, we would be the happiest because it reduces our work/efforts.

- Relativity does not “choose” to follow rules, we are “required” to do so, by Law.

Disclosure:

No Personally Identifiable Information (PII) was disclosed through this post. None of the individual’s privacy rights were violated. The reviews are already in the public domain, accessible to anyone and everyone.

Author:

I am the Director at Relativity. You can connect with me on LinkedIn here.

Leave a reply